Top 10 Advantages of Choosing a White-Label Payment Provider in 2026

The financial landscape of 2026 looks vastly different from what it did just a few years ago. We have moved beyond simple credit card processing into an era of instant settlements, AI-driven fraud prevention, and decentralized finance. For businesses looking to offer financial services, the “build vs. buy” debate has been settled. In a world where agility is the primary currency, building your own payment rails is often a distraction from your core mission.

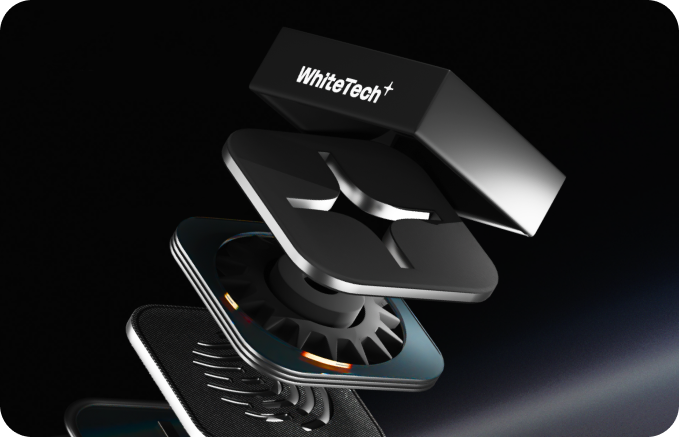

A white-label payment provider allows a company to take a pre-built, fully functional payment platform and rebrand it as its own. Instead of spending years developing complex code and securing banking licenses, you “rent” the infrastructure and put your logo on it. This allows you to offer a premium financial experience without the overhead of a tech giant.

If you are looking to scale your business this year, here are the top 10 advantages of choosing a white-label payment provider like WhiteTech.

1. Lightning-Fast Speed to Market

In 2026, the market waits for no one. The “First Mover Advantage” is more critical than ever. Building a proprietary payment gateway from scratch can take 18 to 24 months of development, testing, and certification. By choosing a white-label solution, you can launch a fully functional, branded payment ecosystem in a matter of weeks. This agility allows you to capture market share and respond to consumer trends while your competitors are still stuck in the development and debugging phase.

2. Drastic Reduction in Development Costs

Developing fintech software is prohibitively expensive. It is not just about the initial code; it is about the constant upkeep. You need a team of high-level developers, security experts, and compliance officers. With a white-label provider, the heavy lifting is already done. You trade a massive upfront capital expenditure (CapEx) for a predictable, manageable operating expense (OpEx). This shift allows you to reinvest your capital into what really matters: marketing, product innovation, and customer acquisition.

3. Regulatory Compliance Handled (PCI DSS & PSD3)

The regulatory environment in 2026 is stricter than ever, with new frameworks like PSD3 and AI-specific financial regulations. Handling financial data requires compliance with PCI DSS Level 1 and various local financial licenses. A white-label provider like WhiteTech maintains these rigorous certifications for you. You get to operate under a “licensed umbrella,” significantly reducing your legal liability and the massive headache of annual audits and regulatory filings.

4. Seamless Brand Consistency and Trust

The “white-label” aspect means the technology is invisible to your end-user. In 2026, customer trust is fragile. From the checkout page to the mobile app interface, every element is customized to match your brand’s aesthetics. Your customers never feel like they are being handed off to a third-party processor, which builds brand equity and reinforces your identity throughout the entire user journey. You own the customer relationship; we provide the engine.

5. Access to 2026’s Cutting-Edge Technology

The payments world is now dominated by AI-driven biometrics, Open Banking, and Central Bank Digital Currencies (CBDCs). A top-tier white-label provider stays at the forefront of these technological shifts. When you partner with WhiteTech, you automatically gain access to the latest updates – such as “one-click” biometric recognition or instant cross-border settlements – without having to write a single line of new code. Your platform stays modern while we handle the research and development.

6. Enhanced Security and AI Fraud Prevention

As payment technology evolves, so do the methods of cyber-criminals. Modern white-label platforms use advanced AI and machine learning to detect fraudulent patterns in real-time. By leveraging a provider that handles billions in transactions across various sectors, you benefit from “network effects.” The system learns from threats across its entire client base, protecting your business from a new type of fraud before it even reaches your specific platform.

7. Global Scalability from Day One

Expanding into a new country usually requires setting up local banking relationships and understanding specific local payment habits, such as Pix in Brazil or UPI in India. A white-label provider already has these global connections established. With WhiteTech, “going global” is as simple as toggling a switch. Our infrastructure allows you to accept hundreds of currencies and local payment methods instantly, removing the geographical barriers to your growth.

8. Focus on Your Core Business Strategy

You are an expert in your industry – whether that is e-commerce, SaaS, gaming, or the creator economy. You are likely not an expert in the complex “plumbing” of financial transactions. By outsourcing your payment infrastructure, you free up your internal resources to focus on your product’s unique value proposition. Let the engineers at WhiteTech worry about API latency and server architecture while you focus on scaling your user base.

9. High System Reliability and Maintenance

When payments go down, business stops, and trust is lost. Maintaining 99.99% uptime requires a massive infrastructure and constant technical monitoring. White-label providers offer Service Level Agreements (SLAs) that guarantee high availability and system stability. By using a platform that is already optimized for high-volume traffic, you ensure that your transaction flow remains steady even during peak periods, without needing to manage the underlying hardware or cloud clusters yourself.

10. Data-Driven Insights and Predictive Analytics

In 2026, data is the most valuable asset. White-label platforms come with built-in, sophisticated analytics dashboards that go far beyond simple transaction logs. You can track customer behavior, churn rates, and payment success levels in real-time. These insights allow you to make informed business decisions, optimize your sales funnels, and offer personalized rewards to your most loyal customers, all through a single, easy-to-read interface.

The Verdict for 2026

The era of “doing it all yourself” is over for smart businesses. To stay competitive in today’s fintech-driven economy, companies must be lean, fast, and secure. Choosing a white-label payment provider is no longer just a “shortcut” – it is a strategic move that provides a professional-grade financial infrastructure at a fraction of the cost and risk.